Bank-to-Bank reimbursements play an important role in the documentary credit process. The use of a reimbursing bank is often a determining factor when a nominated bank decides to honour or negotiate. Banks that are requested to add confirmation will often prefer a reimbursing bank to be nominated in the documentary credit rather than rely on settlement being made directly by an issuing bank upon the issuing bank's receipt of complying documents.

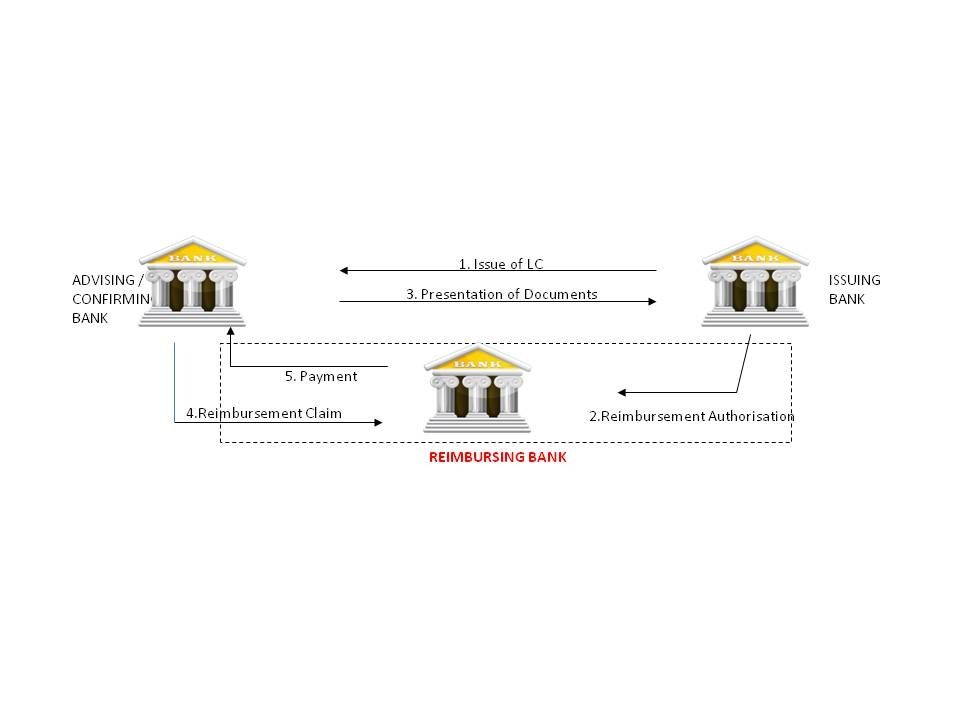

It is, therefore, often the case that an issuing bank will nominate another bank (a reimbursing bank) to provide reimbursement on its behalf.

The use of a reimbursing bank, which is very often located in the country of the currency of the documentary credit, allows an issuing bank to utilise foreign currency it holds on an account with that bank, rather than face exchange rate risks associated with converting local currency to a foreign currency on a payment-by-payment basis.

In such circumstances, the issuing bank, at the time of issuing its documentary credit, should send a reimbursement authorisation to the reimbursing bank instructing it to reimburse the claiming bank (a named nominated bank or any bank should the documentary credit be available with any bank).

The reimbursing bank will usually only pay a complying claim if funds are available in the account of the issuing bank, or where there is a sufficient overdraft facility in place, unless it has issued its own Irrevocable Reimbursement Undertaking (IRU). An IRU irrevocably binds the reimbursing bank to honour a complying demand.

A reimbursing bank has no concern with regard to the documents that are presented under the documentary credit and whether they are compliant or not.

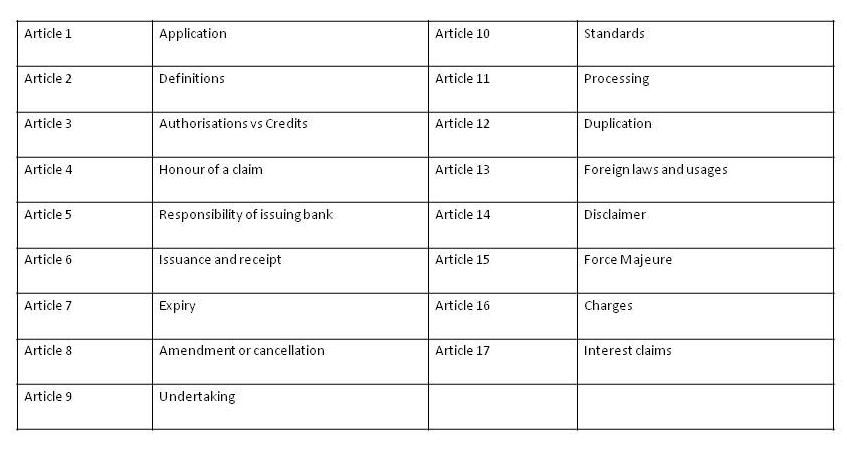

Bank-to-Bank reimbursements may be made subject to the Uniform Rules for Bank-to-Bank Reimbursements under Documentary Credits, ICC Publication No. 725 ("URR 725") or UCP 600 sub-article 13 (b).

UCP 600 article 13 addresses how the applicability of URR 725 is to be indicated, or the process to be followed if URR 725 does not apply.

As stated in URR 725, the key factor is the independence and autonomy of the reimbursement authorisation. It does not depend on the performance of the documentary credit and the reimbursing bank is in no way bound by the terms and conditions of the documentary credit.

In order for URR 725 to apply to a documentary credit, reference to the rules must be expressly included within the reimbursement authorisation.

Such inclusion automatically makes the rules binding on all parties involved, unless there is an express modification or exclusion of part of the rules within the authorisation. Care should always be taken in the event of such modification or exclusion in order to ensure that the authorisation is still workable.

As a logical extension of this, the issuing bank must also state in the terms and conditions of the respective documentary credit that the reimbursement is subject to URR 725.

An agency agreement will exist between the issuing bank and the reimbursing bank resulting in the consequence that the reimbursing bank acts solely on the instructions of the issuing bank.

A recent ICC Opinion addressed an issue whereby an issuing bank had claimed that a reimbursement claim was to be subject to URR 725 despite the applicability of URR 725 not being mentioned in the documentary credit.

Based upon the content of UCP 600, it is the responsibility of the issuing bank to point out whether or not a documentary credit is additionally subject to URR 725. If it does not do so, then the credit is, by default, not subject to URR 725.

In such circumstances, reimbursement is to be handled in accordance with UCP 600 sub-article 13 (b).

It should be noted that the rules mentioned in UCP 600 sub-article 13 (b) are deliberately short, in order to encourage usage of URR 725 as the definitive rules for bank-to-bank reimbursements.

More detailed information can be found in the module ‘Bank-to-Bank Reimbursements in practice' at www.tradefinance.training