What is Blockchain technology?

‘What is needed is an electronic payment system based on cryptographic proof instead of trust' - Satoshi Nakamoto, creator of bitcoin and the blockchain.

An increasing number of digital initiatives are evolving in the payments world. One, which has attracted a fair bit of interest in the market, is bitcoin; a cryptographic means of exchanging value over the internet without an intermediary such as a financial institution.

Whilst there is a growing awareness of bitcoin, this does not appear to be the same for the underlying blockchain technology.

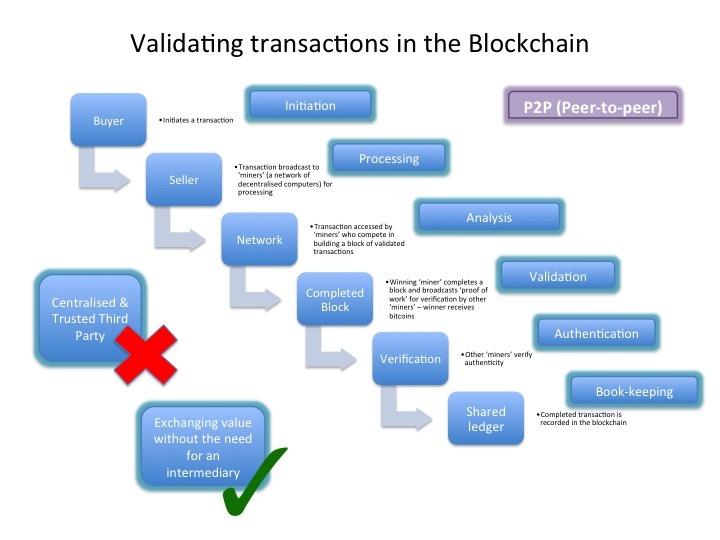

Blockchain can be regarded as a decentralised or distributed ledger for validating and recording transactions. As in the physical world, whenever a transaction is initiated, it requires validation and authentication. However, as opposed to the physical world where such authentication is handled by a trusted third party (often a financial institution), the pending transaction is broadcast to a network of decentralised users (defined as ‘miners') who, using specialised software, compete to verify and authenticate the cryptographic key added to a transaction. In essence, the ‘miners' are verifying and confirming a bookkeeping record. For this activity, known as ‘proof of work', they receive a reward in bitcoins.

Once a block of transactions is verified, it is validated by other ‘miners' and added to the blockchain. Having passed through this complex mathematical process, the ledger provides irrefutable evidence and proof of a transaction in respect of ownership and history: ownership of the transaction has been established by a network of computers rather than a centralised authority, a dramatic development compared to the norm.

For the sake of this article, we have greatly simplified the process. More information can be located within the source material referenced below.

The decentralised ledger is public and not owned by any individual or group of institutions. It therefore works as a trust alternative to an intermediary and, by reducing the involvement of other parties, reduces cost. This concept and structure is known as P2P (peer-to-peer) i.e. no financial institution, trusted third party, middleman or intermediary is required.

With appropriate software, it is possible to view every transaction concluded within the blockchain. However the identification of the ‘owner' remains private, unless they wish to reveal it, and is represented by a string of letters and numbers. The decentralised ledger provides a key benefit in that it avoids overlap and duplication of work. There is no longer a need for two (or more) institutions to record and monitor a transaction, leading to a dramatic reduction in cost and time.

How is the blockchain currently used?

Fig. 1 Blockchain validation

As already mentioned, the most common type of digital transaction utilising the blockchain is bitcoin. A bitcoin is a unit of digital currency and does not exist in the physical world.

The first mention of bitcoin was in 2008 via publication of a paper by Satoshi Nakamoto entitled ‘Bitcoin: A Peer-to-Peer Electronic Cash System'. The real identity of the author has never been established.

The combination of bitcoin and blockchain has the potential to produce a payment network that is cheaper, faster, more efficient and transparent.

However, blockchain is not restricted to payments. It can equally be utilised to transfer ‘value' for other digital assets. The functionality is in place to register, confirm, authenticate and transfer ownership of any kind of tangible asset in a digital format.

Evolving technology such as the ‘Internet of Things (IoT) takes this concept to an entirely new level. In brief, IoT, by embedding sensory and wireless technology within objects, makes it possible to digitally transfer ownership of all kinds of physical property. The technology has an additional benefit in that it also provides the ‘object' with the ability to transmit data in respect of identity, existing condition and the environment in which it is based.

The functionality to register, confirm, authenticate and transfer ownership can equally apply to intangibles such as contractual agreements, shipping documents, commercial documents, notarised documents, insurance documents and other types of documents and certificates, all of which can be cryptographically controlled.

Having access to real-time data would facilitate the formulation of contracts and documents on an automated basis provided that the underlying required criteria is verified by the blockchain, thus producing what is known in blockchain terminology as a ‘smart contract'.

A smart contract would not require the intervention of an intermediary such as a bank or a lawyer, as it has removed the need for the trust of a ‘third party' by basing the trust element upon a secure mathematical code. The code underlying the contract would execute when a triggering event occurs rather than drafting a contract on a case-by-case basis.

Potential in a trade finance environment?

We are still at the infancy of this technology and very few institutions have taken this too far apart from identifying that, in addition to existing initiatives, there is potential for trade financing.

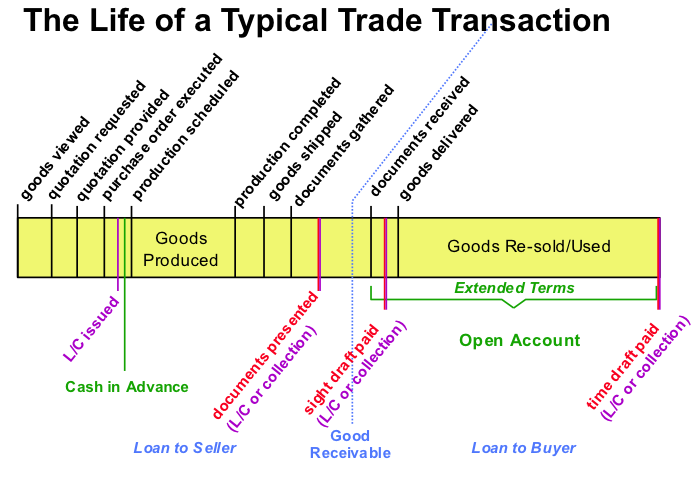

Fig. 2 The Life of a Typical Trade Transaction

Many advantages could arise from the application of blockchain technology across the supply chain and the below are merely an indication of the areas of potential. Not only do these provide the obvious associated advantages, they could also be used to facilitate financing at lower rates than usual due to the availability of real-time information.

It is important to bear in mind that a number of existing digital trade initiatives can already address a number of the above issues. However, provided that blockchain technology can achieve its potential, the rewards may be exponentially greater.

Where do we go from here?

It is difficult to know how or when blockchain technology will impact upon the world of trade.

We can be sure, however, that the digital revolution is not going away and that dramatic changes will come into place over the next 5-10 years. The trade world is far too paper-intensive and cost-heavy for change not to come.

This technology is to be welcomed if it can provide efficiency and cost benefits including those envisaged above.

The interesting question revolves around which industry will drive this. Trade financing has historically been the domain of financial institutions, primarily due to the trust element. In recent years, the global financial crisis has, quite clearly, negatively impacted upon that trust factor. Furthermore, financial institutions can rarely move as quickly as, for example, technology companies.

The emerging Fintech (Financial Technology start-ups) sector has a growing and leading influence in this area. No doubt they are faster-to-market and more innovative, but do they have the necessary capital or required network of partners and clients?

The obvious ideal would be for financial institutions and Fintech to work together and there is already evidence of this happening.

The next 18 months will see the first ideas materialising - this could be a fascinating time to be involved in trade.

Sources:

Blockchain Blueprint for a new economy: Melanie Swan - February 2015

Block Chain 2.0: The Renaissance of Money - Wired magazine: Kariappa Bheemaiah - 2015

Cryptocurrency: Paul Vigna and Michael Casey - 2015

Deutsche Bank ‘Talking point - Blockchain (Fintech 2)' Thomas F. Dapp / Alexander Karollus - July 2015

Techworld: Why banks are betting on the blockchain - not Bitcoin - to transform the financial sector - August 2015

The Fintech 2.0 Paper: rebooting financial services - Santander InnoVentures, Oliver Wyman, Anthemis Group - June 2015

Wall Street Journal: Deutsche Bank exploring blockchain uses - July 2015

Bitcoin Fact Fiction Future: Deloitte University Press - June 2014

http://www.bloomberg.com/news/videos/2015-10-06/the-future-of-finance-blockchain-in-the-banking-industry - October 2015