Since time immemorial, the trading of goods and the provision of services has been a key basis and tenet for human existence. The earliest forms of trade, prior to the existence of money, depended on barter and exchange of goods.

The introduction of the written word and forms of monetary exchange brought with them the opportunity for innovative financing solutions for trade. Moving forward to more recent times, many financial instruments exist which facilitate trade.

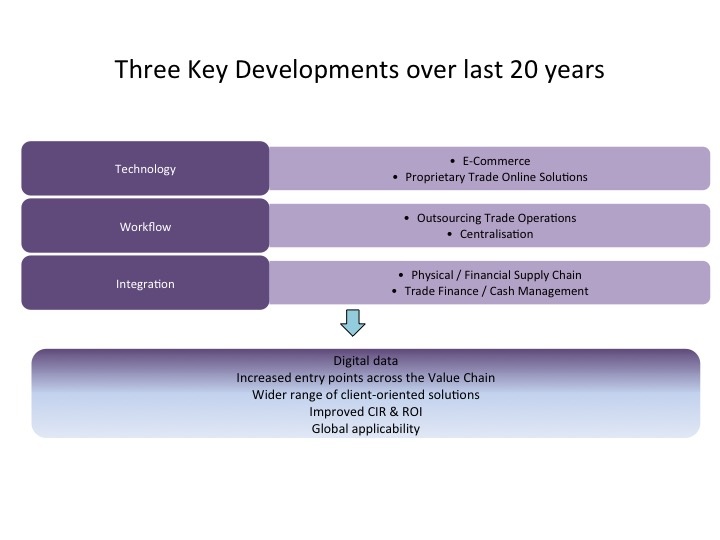

Traditional trade finance has provided enormous benefits to traders but the problem has been that many of these solutions are predicated upon a paper environment. Dematerialisation into a digital format is the obvious way forward. Whilst the physical supply chain moves more quickly each year, the financial supply chain has been playing catch-up, often far behind.

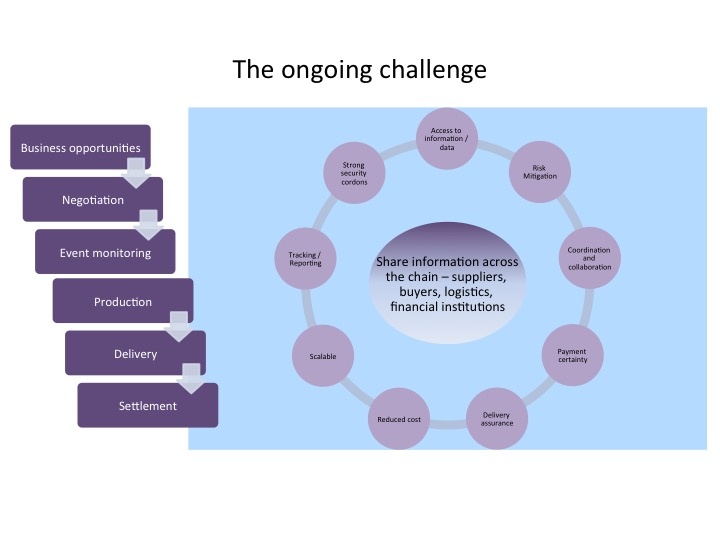

Closer matching of the physical, financial and information supply chains will continue to energise innovative financing solutions in the future. Integration of data and information is, and will be, the basis of future trade solutions. Technology has affected the lives of people all around the world particularly in the last few decades. These benefits are now surfacing in the trade finance arena as digital information becomes more readily attainable, convenient and available.

The key to this success has been, and will continue to be, common standards for the sharing of data and information. Each party involved in a trade transaction needs to have access to data easily, cheaply and quickly.

Buyers and sellers require financial intermediaries to: